PORTLAND, Ore. (KOIN) — Jon Harder had access to it all.

At the height of his “success,” he touted his wealth to be $300 million. He maintained an “obscene” standard of living, according to federal prosecutors.

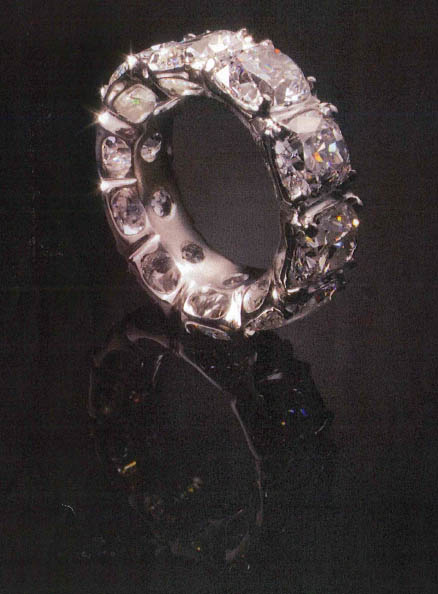

Private jets. Six homes. Luxury vehicles. Even diamond rings worth far more than a typical down payment on an average priced American home.

Harder, according to federal prosecutors, was a man fueled by greed. They described his crimes as a “weapon of mass financial destruction.”

On Tuesday, U.S. District Judge Michael Simons sentenced Harder to 15 years in prison, which is the amount of time Assistant United States Attorneys Michelle Holman Kerin and Allan M. Garten had sought. Harder’s attorneys asked for 5 years.

Harder, according to court documents, is responsible for what federal authorities believe is the state’s largest investor fraud. Federal prosecutors describe Harder’s crime as “egregious” and say the damage is “truly stunning” in its breadth and scope.

By conservative estimates, Harder siphoned $130 million from more than 1,200 investors and banks.

Harder was the former president and CEO of Sunwest Management Inc. The company was founded in February 1992. It eventually became the fourth largest senior housing facility in the country.

The scheme, officials say, ran undetected for several years. According to the FBI, agents opened an investigation in 2008. Special agents conducted “hundreds of interviews and gathered and reviewed more than a million pages of documents,” the bureau said in a press release.

In January 2015, Harder plead guilty in federal court to one count of mail fraud and one count of felony money laundering.

His plea deal led him to admit that beginning in late 2007 through February 2008, he lied to more than 50 investors to obtain more than $5 million.

Federal prosecutors say Harder portrayed himself as an ethical and honest businessman who controlled a network of companies that bought, constructed and managed a nationwide portfolio of assisted living facilities.

His house of cards toppled when investigators from the U.S Postal Service, FBI, IRS, and U.S. Bankruptcy Trustee’s Office discovered Harder was running what prosecutors describe as a “Ponzi scheme.”

The scheme was based on false promises Harder made to investors. They were promised annual returns of 8-10%.

Those investors were left devastated and in a perilous financial situation. Victims were told they would be investing money in specific assisted living facilities and that Sunwest was on solid footing.

In reality, the money investors thought was going into specific facilities was actually commingled into bank accounts that Harder had access to, and would end up diverting millions to support his lavish lifestyle.

Investigators learned by 2006, Sunwest was losing millions of dollars a year. The company was in disarray, hemorrhaging cash, but investors had no idea. Some of the facilities run by Sunwest were only partially filled and often in disrepair. Payments to vendors were delayed. But Harder was able to cover his tracks.

He relied on cash infusions from investors in order to mask the failing business practices. Harder traveled the country to solicit new investors and bank loans.

The duping continued until June 2008 when the scheme came to a head.

“Knowing the full extent of the dire financial predicament of Southwest, Harder continued to defraud and mislead,” a federal sentencing memorandum states.

Many of his loans were in default and the company was on the verge of bankruptcy. The company collapsed into the deep cash hole Harder had dug.

The vast majority of Harder’s victims were elderly. The pitch to these elderly investors was deliberate and calculated. Harder’s marketing strategy was to target individuals who were retiring and wanted a simplistic investment experience.

These people could not afford to lose the money they were investing in Sunwest.

“Jon Harder deceived the very people (who) depended on him to care for their investment, paid for by monies that in many instances took lifetimes to acquire,” federal prosecutors wrote in a sentencing memorandum.

The scheme “decimated” the savings of many investors and destroyed countless lives.

One of the investors, a 68-year-old man with polio, met with Harder and explained that he was disabled and needed the income from the investment to live.

The man handed Harder a check for $1 million. The man now lives off social security and the little money he has borrowed from family and friends.

“Calculating. Deceitful. Greedy. Audacious. These are all terms that aptly describe the defendant’s actions in this case,” stated Special Agent in Charge Teri Alexander of IRS Criminal Investigation. “In order to maintain the health of our economy, the law demands that we keep these characteristics in check. IRS CI special agents will continue to bring their unique financial expertise to prosecution teams whose goal it is to root out unchecked greed and to bring some sense of justice to the victims left in the perilous wake of the unscrupulous.”

“Jon Harder targeted some of the most vulnerable people in our community. Retirees who invested their life savings. Seniors who depended on the assisted living facilities to care for them and keep them safe. Harder’s greed led to a lavish lifestyle of homes and cars and trips that most people could only imagine. It is only fitting that that greed now will lead him to years behind bars,” Greg Bretzing, the Special Agent in Charge for the FBI in Oregon, said in a news release.

The victims were forced to make new plans to support themselves. Many of the investors were already at, or close to, retirement age. Making matters worse, the 2008 stock market crash caused some victims to lose significant portions of their other financial investments. The housing market slowed. Investors looking to sell their homes just to “get by” found the value at a lower price.

While the victims struggled — many having to come out of retirement — Harder used their money to maintain his “incredibly lavish lifestyle,” federal prosecutors said. Records show Harder had monthly personal expenses that ranged from $200,000 to $600,000 a month.

The company maintained three aircraft, including a high performance “Bombardier” jet that cost $20 million. Harder used those planes to fly into vacation resorts in Alaska and the Cayman Islands.

“He lived as well as one could possibly live,” Allan M. Garten: Assistant United States Attorney

Harder had six homes — including one in the Pronghorn development — an exclusive, gated golf country club in Bend. His main residence, in Salem was situated on the banks of a private lake. He had a large staff at his home, including private tutors — at the rate of $6,200 per month — for his daughter.

“No extravagance was too much — when (Harder’s) daughter studied Ireland, he flew the teacher and the whole family flew first class to Ireland,” according to the federal sentencing memorandum. In February 2008, when his daughter started studying turtles, Harder flew the family down to the Galapagos Islands.

Some would say the scheme even had “deadly” consequences.

One victim “believed his wife died, in part, due to the stresses associated with the money they lost after 50 years of hard work,” according to the sentencing memorandum. Another victim told federal prosecutors she “believes the stress associated with the money her father lost, shortened his life.”

Federal prosecutors say Harder “has not accepted responsibility” for his crimes. He shifts blame to everyone else and “utilized clever mechanisms” to ensure his victims don’t further recoup their significant losses.

In a letter to the court, Harder apologizes for the collapse of Sunwest but not for his lies and deceit which caused people to invest in the company in the first place, according to federal prosecutors.

“There are no words that can adequately convey the pain I feel for the collapse of Sunwest, the investment losses sustained by the investors and the relationships destroyed,” Harder wrote in a statement to the court.

“(Harder) has done little, if anything, to acknowledge the lies he told investors,” federal prosecutors wrote.

Harder, born in Kansas, moved to Canyonville, Oregon with his family when he was 4 1/2 years old. He was first introduced to assisted living facilities around the age of 12 when his father worked as a plumber at a senior home. He graduated Walla Walla College in 1989 with a Bachelor of Science in Business Administration.

His attorneys wrote in court filings that “there is no evidence that Mr. Harder committed the scheme to defraud…simply to gain and aggrandize personal wealth…Nor is there any evidence that Mr. Harder intended or foresaw the loss suffered by the Sunwest investors as a result of Sunwest’s collapse.”

Harder and his defense attorney dispute the claims that Harder’s crimes are the hallmark of a classic Ponzi scheme.

“For years, the SEC, the government and the media have portrayed Sunwest as a Ponzi operation despite the fact that the evidence does not support this claim,” his attorneys wrote.

His attorneys provided the court with a clearer picture of the reality Harder has faced since his indictment. For the past four years, he has lived in a shared, small house in North Dakota with seven other men.

Harder’s defense team sought a 5 year prison sentence — calling it “sufficient but not greater than necessary.”

They point out that this is Harder’s first conviction and that a five year sentence is “not a slap on the wrist: it is 260 weeks, 1,825 days. Anyone who thinks five years incarnation is a slap on the wrist has not visited a federal prison lately.”

For his part, Harder writes to the court that he is “sorry” for letting down his longtime friends, investors, employees and banks. “I feel incredibly badly for all the carnage and problems that I have caused.”

“I know I was reckless by growing so quickly, and in using other people’s money to do so, but I never intended to harm anyone,” Harder wrote.

The formal sentencing of Harder was in itself atypical. There had already been a “Phase One” that lasted three weeks. That itself is longer than most trials in the district of Oregon. Harder has already acknowledged he intends to appeal, according to court filings.

“Phase Two” of Harder’s sentencing concluded in federal court in downtown Portland on Tuesday.

“From our stand point, basically, this was a weapon of mass financial destruction,” Garten said. “There were thousands upon thousands of people who were directly or indirectly impacted by the crimes committed Jon Harder.”