PORTLAND, Ore. (KOIN) – The court continued to hear more about the Brophys’ finances from a financial expert witness who continued her testimony Wednesday morning.

Tiffany Couch is a certified public accountant and owner of Acuity Forensics. Couch is certified in financial forensics and is a certified fraud examiner. On Tuesday, she testified saying the Brophys’ financial situation appeared to be improving in the two years leading up to Daniel Brophy’s murder.

Nancy Crampton Brophy is charged with murdering her husband, Daniel, at the Oregon Culinary Institute on June 2, 2018. In its case, the prosecution argued that she may have been motivated to kill him to cash in on Daniel’s life insurance plans and avoid the financial ruin they were facing.

Couch painted a very different picture of the couple’s financial situation.

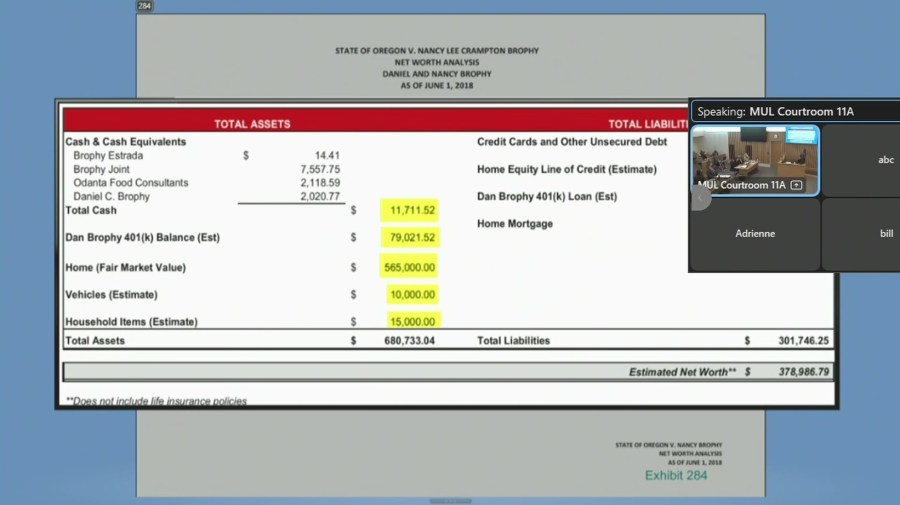

She started off her testimony Wednesday by saying that based on her calculations, the Brophys had an estimated net worth of $378,987.

She said when an individual or family is on a financial cliff they do things like miss debt payments, have debt payments that are in excess of the funds they are bringing in, and spend excessively on credit cards. She said the Brophys weren’t doing any of these things.

When the prosecution had a chance to question her, they asked about the Brophys’ missed mortgage payments that had added up to more than $8,000 before the Brophys took out a $35,000 loan from Daniel’s 401K to repay the amount.

Couch agreed this was a financial challenge they needed to do something about. She said anyone in that situation would have either needed to take out a loan or sell their house. The Brophys chose to take out a loan.

KOIN Coverage: The murder trial of Nancy Brophy

The prosecution asked her if she thought it was strange the Brophys neglected their mortgage and instead chose to make other payments, like paying for their life insurance premiums.

Couch said she also did not find this unusual because the Brophys were paying off their credit cards.

“I kind of liken it to, if you’ve ever heard of Dave Ramsey or Suze Orman or those folks, they’re money-manager people, and what do they tell us? You pay down your high-level consumer debt first and then, you know, go after your next steps next. You can literally see that in these bank accounts,” Couch said.

She said in her opinion, the bank accounts show the Brophys had a plan to tackle their debt and were achieving it.

Couch also said taking a loan out of a 401k to save a house is a reasonable thing to do. She’s also seen people take loans out of their 401k accounts to pay for their taxes.

Couch said she listened to the prosecution’s opening statement and the scenario they described of the Brophys facing financial ruin. She said from what she’s seen with their eight bank accounts and assets, that that scenario description is not close to what was actually happening.