PORTLAND, Ore. (KOIN) – Oregon economists predict the state’s kicker will return a record amount to taxpayers in 2024. According to the most recent economic and revenue forecast, the personal income tax kicker is projected to be $3.9 billion.

The kicker is paid out as a tax credit when Oregonians file their taxes and people receive different amounts depending on their income.

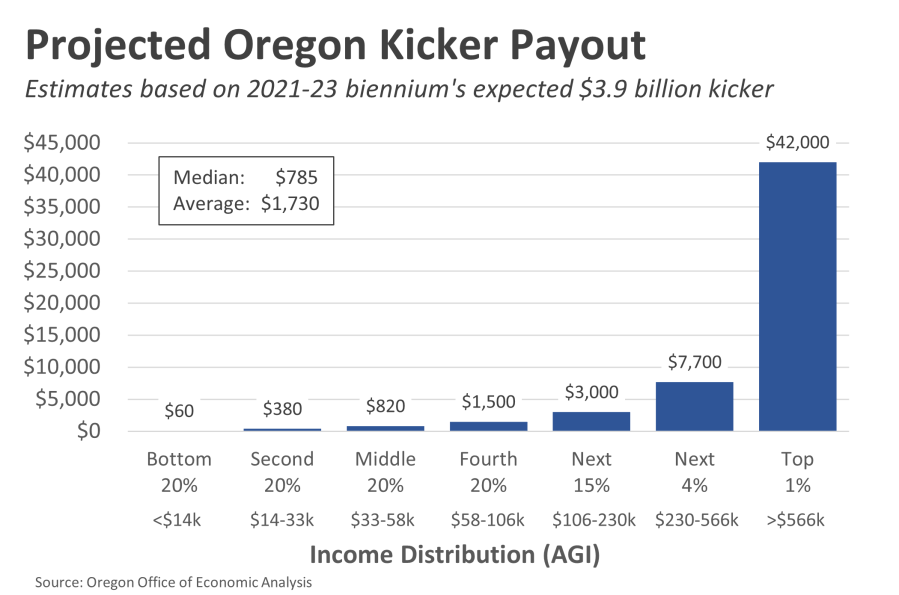

The Oregon Office of Economic Analysis released predictions Wednesday of how much Oregonians will get.

“Keep in mind that Oregon pays the kicker out the same way we take the revenue in, based on one’s tax liability,” explained Oregon State Economist Josh Lehner. “The more you earn, the larger your kicker.”

He said every taxpayer receives the same credit percentage on their taxes, but that does not mean each person received the same dollar amount.

Based on Oregon’s current income distribution and the current projected kicker amount, economists predict the typical Oregon taxpayer will receive a $785 credit on their tax returns in 2023. Those higher up will receive four- and five-figure kickers.

The average Oregon taxpayer whose income is in the top 1% will receive a kicker of an estimated $42,000.

The bottom 20% of incomes, those who earn less than $14,000 a year, can expect about $60.

Lehner said the economic impacts of the kicker will differ depending on what’s being measured. At the macro level, he said the impacts will be noticeable. After all, Oregonians are about to get a $3.9 billion increase in disposable personal income in 2024, a boost of about 1.3 percent.

However, in terms of consumer spending or increased revenues for local businesses, he expects the impact will be less than that, since some people will choose to spend the money and others will choose to save it.

There have been previous studies done on what the consumer spending impact of the kicker could be. The Oregon Office of Economic Analysis said those studies showed consumer spending could be anywhere from 15-40%.

It’s a wide range because researchers say it depends on a household’s income. A lower-income household that lives paycheck to paycheck is more likely to spend the largest percentage of its kicker. A higher-income household, on the other hand, will save a larger amount.

Since the majority of the kicker dollars will be paid out to high-income households, because of how much they pay in taxes, the amount of kicker money people are likely to spend is a smaller fraction of the total paid out.

The final kicker figures will be certified in fall 2023.