PORTLAND, Ore. (KOIN) – The pandemic boom may be coming to an end for Oregon’s cannabis industry.

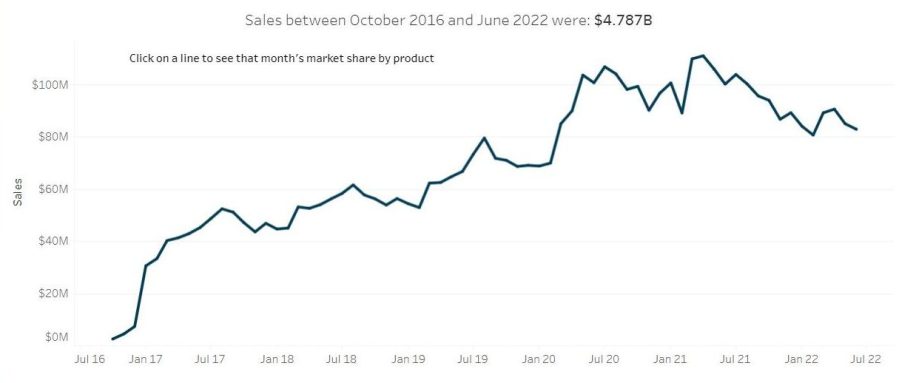

After two consecutive years of sales topping $1 billion, revenue has been dropping since April.

In June, sales totalled $82,723,244. It’s only the second time sales have dropped below $84 million since the start of the pandemic.

Experts said there are several factors contributing to the decrease in dollars sold, a few of which include consumer trends, the role inflation is playing on the market and the price at which retailers can sell their products.

Beau Whitney conducts cannabis market research for Whitney Economics and said his company predicted there would be an increase in cannabis consumption early on in the COVID-19 pandemic, but that sales would slide downward as soon as people return to working in-person.

“The assumptions were that consumers would be working from home. They could consume cannabis while working without having any issues about driving or going into the workplace while under the influence,” he said.

Sales trends documented by the Oregon Liquor and Cannabis Commission seem to reflect this.

The dollars sold for marijuana products climbed in the early months of the pandemic and remained high – eventually peaking at $110,804,219 sold in April 2021.

It took a downward turn in summer 2021, as mask mandates were lifted and people returned to work, then rose again slightly after February, a time when some employers chose to send workers home to help prevent the spread of the omicron variant. But as employees braved their workplaces again in spring, it appears they left their cannabis spending money at home.

“We put something out almost a year ago predicting that this back-to-school, back-to-work would have a significant downward impact on the demand, and sure enough it did,” Whitney said.

He noted that if the pandemic had not occurred, sales might have remained where they’re at now. He said at some point, models predicted there would be a maximum number of consumers participating in purchasing recreational marijuana and that sales would level off after the initial post-legalization spike.

Eventually, he said growth rates would be based more on population rather than any sort of legal participation.

Surplus supply drives down price

Mark Pettinger, spokesperson for OLCC said their numbers show the upward trend was slowing between 2017 and early 2020.

However, he points out that the price of cannabis products should also be considered when watching sales trends. He said due to a surplus of cannabis grown in Oregon, the price of cannabis products has dropped considerably.

The amount of cannabis harvested in Oregon in 2021 was higher than any year since recreational use became legal.

“I drove by earlier today and saw one place selling cannabis for as low as $2 a gram. I don’t think we would have assumed or predicted that when we began allowing retailers to sell cannabis back in 2016,” he said.

Whitney’s firm estimated in 2021 that in Oregon, there was approximately 574,000 pounds of cultivated output demand.

He said growers tend to produce 1.1 million pounds of dried cultivated output, more than double the legal demand in the state.

Retailers could fall into ‘death spiral’

The combined effect of decreased demand, increased costs due to inflation and the low price of product are negatively impacting local retailers and causing them to fall behind, Whitney said. He’s calculated that it takes about $2.5 million per year for cannabis retailers to remain viable. But right now, the average retailer only generates about $1.4 million.

That money has to cover labor, rent and federal taxes. When businesses fall behind on those things, they enter what Whitney said is known as a “death spiral.”

“Once they get behind, then it’s really tough for them to catch up. And so, the retail sector right now is under water,” he said.

Inflation could drag businesses down even deeper.

Whitney said the cost of cannabis hasn’t been driving customers away, since the price of products has been so low, but Pettinger disagrees. He believes people feel less inclined to buy marijuana when they’re spending more on things like gas and groceries.

Retailers have also been feeling the effects of inflation when it comes to paying more to transport their goods and paying higher costs for labor, Pettinger said.

Will things improve?

Whitney and Pettinger agree that relief could come to Oregon’s cannabis industry if the federal government allows for the sale of interstate commerce and Oregon could ship some of its harvest out of state. But that could still be years away.

“In the Oregon market, it’s just going to be a tough road,” Whitney said.

The OLCC said it wants to do all it can to support retailers. Starting Jan. 1, a law went into effect in Oregon placing a moratorium on issuing production and retail licenses in the state. The OLCC hopes this might help balance the market.

The OLCC also sent a letter to each of Oregon’s congressional representatives in early July, urging them to remove federal barriers that prevent legal cannabis businesses from obtaining access to banking.

As far as whether Oregon’s cannabis industry will reach $1 billion for a third year in a row, Pettinger said the state will have to wait to see what sort of harvest it has this fall.