PORTLAND, Ore. (KOIN) – The Brophys were in financial distress, according to a police investigative accountant who testified on the 11th day of Nancy Crampton Brophy’s murder trial Wednesday.

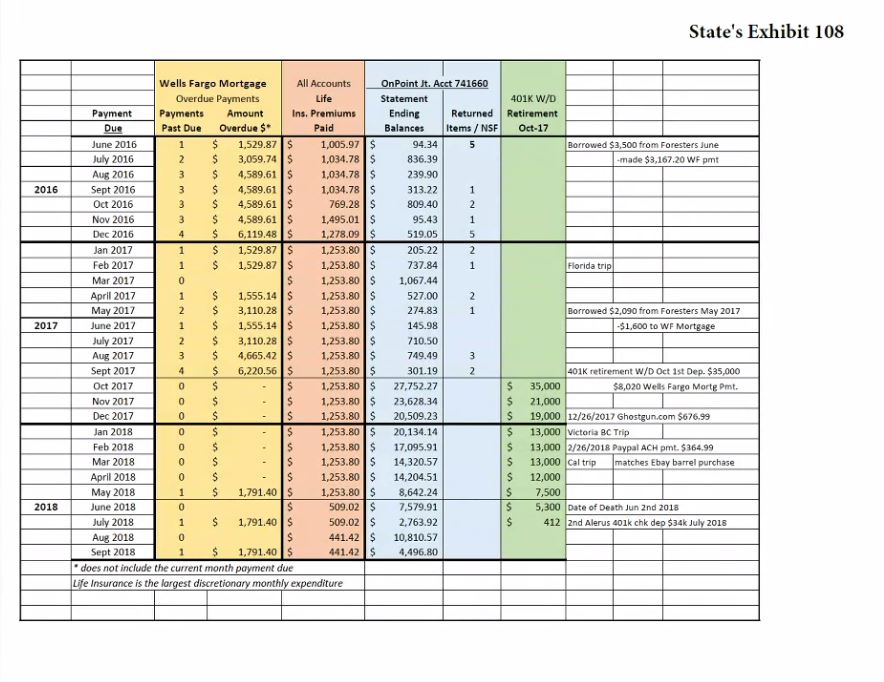

The investigative accountant testified for most of the afternoon about how the Brophys were falling behind on their mortgage before taking a $35,000 loan out of Daniel Brophy’s 401k retirement account to pay off their deficiency.

Nancy Crampton Brophy is charged with murdering her husband, Daniel, at the Oregon Culinary Institute on June 2, 2018. Her trial began on April 4, 2022. The prosecution believes the looming threat of her financial ruin was one of Nancy’s motivating factors in the murder.

On Wednesday, the prosecution called some of its final witnesses. In addition to Rober Azorr, the investigative accountant, they called Michele Reveneau, who used to cut the Brophys’ hair; Tania Medlin, a close friend of the Brophys; and Andria Alderson-Such and Stephanie Eakin who both work for SAIF Corporation, a workers compensation carrier.

The prosecution plans to rest its case Thursday after the cross-examination of Azorr is completed.

Here are six takeaways from Day 11 of the trial:

“Nancy was… somebody I looked up to”

Tania Medlin said she knew Nancy and Daniel for 25-30 years before Daniel’s death. She and Nancy were roommates while Nancy was in culinary school. Medlin, a former culinary school student, said she knew of Daniel because they ran in similar circles.

Medlin said she and Nancy have stayed in touch over the years and have always seen each other at least a few times every year.

“Nancy for a long, long, long time is just somebody I looked up to, somebody, you know, she was one of my dearest friends,” Medlin said.

In 2016, Medlin was managing the kitchen at Avamere Rehabilitation in Beaverton. She needed another chef in her kitchen and Daniel stepped in to help. She said this gave her an opportunity to know Daniel better.

From what she could tell, the Brophys had a relatively good relationship.

Nancy was never one to show emotions

After Daniel died, Medlin said she saw Nancy fall apart. But when asked about the fact that some witnesses said Nancy did not show much emotion regarding her husband’s murder, Medlin said that was just the way Nancy was.

“Nancy is business, very straightforward, to the point, don’t beat around the bush,” Medlin said. ‘When it happens to her and stress hits her, she goes right in, like marching steps… ‘In order for me to keep moving, I’ve got to put the next foot in front of the other one.’”

Medlin said she’s seen Nancy frazzled before and her reaction was the same. She also said Nancy’s emotions were about the same when she learned her brother died about a week after Daniel.

Nancy could receive more than $400,000 in workers’ compensation payments

Andria Alderson-Such took the stand Wednesday and said she was a senior claims adjuster for SAIF Corporation in 2018 and was assigned to Daniel Brophy’s workers’ compensation case.

She said SAIF can withhold workers’ compensation pay-outs to beneficiaries until after police finish investigating a case. However, she and her manager decided to start voluntarily paying Nancy in the interim because they felt it was the right thing to do. The spousal benefit she received from the pay-out was just under $2,800 per month.

Alderson-Such started the payments on July 31, paying Nancy for both June and July. Nancy received a third month’s payment on August 31 before she was arrested. After her arrest, Alderson-Such put a stop payment on the last check issued.

Stephanie Eakin from SAIF Corporation also testified. She was asked to investigate the case after Nancy’s arrest.

In her report, she said that based on their projection, which takes into consideration things like a beneficiary’s age and life expectancy, Nancy was expected to have received $430,984.33 in workers’ compensation payments as a result of Daniel’s death at his workplace, the Oregon Culinary Institute.

The Brophys were “flirting with foreclosure”

When Robert Azorr, the Portland Police Bureau investigative accountant, testified, he said he was asked to examine the Brophys’ bank accounts and finances from June 2016 to September 2018. Based on what he saw, he believed the Brophys were in financial distress.

In 2016, the Brophys had fallen four months behind on the mortgage payments.

“When you’re four months past due, you’re flirting with foreclosure,” Azorr said.

They remained in mortgage loan deficiency until September 2017 when they took out a $35,000 loan from Daniel’s 401k account.

Even after this loan, Azorr said the Brophys’ financial situation remained under distress in a different way. He said borrowing from retirement had to have been stressful for them and they did not change their spending habits. They were still paying to dine out at restaurants relatively frequently, enjoy Starbucks drinks daily and continued to book expensive trips and vacations.

Retirement loan was about 50% of Daniel’s total 401k

Azorr said he doesn’t know why Nancy and Daniel didn’t take a smaller loan out of Daniel’s 401k account. He said the mortgage payment they needed to make to Wells Fargo was $8,020 at the time they took out the loan. He thinks a $10,000 loan would have been more practical.

Instead, the Brophys spent the remaining balance from their loan on things like their everyday expenses, maid service and landscaping.

While continuing to review the Brophys’ finances, Azorr noticed that Nancy received a payment of $34,000 in September 2018 from Daniel’s 401k company. He assumed this was a pay-out and that this amount would suggest the $35,000 loan totaled about half of Daniel’s 401k retirement savings.

The defense pointed out that the Brophys had repaid some of that loan and Azorr agreed. The outstanding balance was $30,684.

Could the financial situation have been avoided?

Azorr said he felt the Brophys’ financial situation could have been avoided. As mentioned, he thought cutting back on their expenditures would have been a good start. When the Brophys began skipping mortgage payments, he saw no changes in their spending habits.

He said there were times the Brophys would start to catch up on their debt, but then they’d repeat their habits and fall back into the same situation.

He pointed out that their life insurance payments, which almost always cost more than $1,000 each month, could have been reduced or eliminated in some way to help ease their financial stress.

Nancy’s purchases of two firearms didn’t improve the situation either, he said. The payments for both the Glock 19 purchased at the gun show and the ghost gun kit came out of a checking account that was primarily used by Nancy.

Azorr also said it would make sense for a couple in the Brophys’ situation to consider selling their house or downsizing.