PORTLAND, Ore. (KOIN) — A ranking that experts say is a key indicator for national real estate investors’ interest in developing in Portland has seen a dramatic downturn in recent years, going from one of the top cities to near the bottom of an 80-city ranking, and plummeting particularly in the last year.

Experts point to national trends like the city’s struggle through the COVID-19 pandemic and subsequent economic toll as well as general market conditions for a drop in ranking. Another factor experts think contributed to the fall is Portland’s sullied reputation in the last year from negative and disproportionate national media attention related to protests.

The ranking was compiled by the Urban Land Institute in its “Emerging Trends in Real Estate 2021” report, in an annual ranking called “Overall Real Estate Prospects.” It was derived from a national survey of over 1,300 personally interviewed individuals and over 1,600 people who gave survey responses–all of whom work in the real estate investment industry or an adjacent field in one capacity or another. The survey was conducted in late fall of last year and includes both residential and commercial real estate prospects, such as offices and hotels.

Chris Nelson is a volunteer District Council Chair in Portland for ULI, which he said is a non-partisan research institute that promotes the responsible use of land and development for cities across the nation. Nelson also works in the real estate development investment business in Portland as Principal of Capstone Partners LLC.

Broadly speaking, Nelson said Portland and other expensive cities with popular cores have dropped on the list, with former hot spots like San Francisco, Seattle, Brooklyn and Washington D.C. also slumping lower on the list in favor of cities that are generally a little less urban and more suburban in character, such as Raleigh/Durham, NC (currently at No. 1); Austin, Texas (ranked No. 2); Nashville, TN (No. 3); Dallas, TX (No. 4); and Charlotte, NC (No. 5).

“Those are not cities that have five years ago been at the top of the list. But one thing I would say they all have in common is, they’re a lot more affordable. There’s been more economic job growth. Those cities are more open for business, I would say, and more business friendly in a lot of different ways,” Nelson said.

The trends in how cities are favored by real estate investors seems to reflect a national migration from more populated urban areas to the suburbs, according to U-Haul migration patterns tracked by ULI. The pandemic likely accelerated what had already been an emerging pattern even before COVID hit the U.S., the report said.

Nelson said some of the property damage that has occurred from protests at places like Portland, Seattle and San Francisco have also had an impact and that it will take some time for those cities to heal.

But no city in recent years has dropped quite as precipitously in the report as Portland has, going #3 on the list in 2017 to #66 in 2021. Portland floated near the top 20 in the interim years from 2018-20.

“I would say the biggest sort of factor that gave us even the worst ranking in that comparison set is we had a disproportionate amount of headline news on our city during a lot of the protests,” Nelson said. “President Trump really sort of poked his eye on Portland and Seattle, right. And that headline news is, I think, to some degree reflected in this ranking.”

Dr. Mike Wilkerson, Director of Analytics for EcoNW, a local economics consulting firm, agrees with the assessment that a major factor in the ranking has to do with Portland seeing a disproportionate amount of negative headline news surrounding protests, compared to other cities, in the last year.

“I think this is really the perception of what you saw playing out in media, social and mainstream, on all of the protests, etc., happening, which as we know, in Portland, was limited to a very small area,” Wilkerson said. “But I don’t think there’s broad understanding of how that’s different than going 10 blocks away over to the central eastside, right. Nevertheless any of the suburbs that are entirely removed from that.”

Wilkerson said it’s that “reputational damage” that has plunged Portland more dramatically lower on the list than Seattle, for example, which he said only dropped from 16th to 34th since 2019.

Wilkerson said his assessment is in line with another survey commissioned by Travel Portland, which is a non-profit that promotes Portland as a travel destination that drives economic impact, in regard to people’s perceptions of tourism and vacationing prospects. The survey, conducted by Engine Insights, found that 69% of respondents said they had generally seen Portland mentioned negatively in the media. The Travel Portland survey, conducted in late 2020, marks the first time since the quarterly surveys began in 2019 that more respondents considered Portland unappealing than appealing, from a tourism lens, Travel Portland confirmed to KOIN 6 News. However about half of respondents said they were neutral on that metric.

In addition, the Travel Portland survey found, from a tourism standpoint, that the majority of people who previously visited Portland are likely to visit again–75% said “yes” in quarter 4 of 2020.

Perception vs. reality

At a recent Bureau of Development Services finance committee meeting, Wilkerson said the ranking is the best tangible metric, as far as real estate goes, on people’s perception of the city, nationally.

However he said the same way the ranking dropped very quickly, it can recover quickly. “Because this is sentiment. And as we know sentiment can move pretty quickly, particularly in real estate.”

Nelson said while the national investor sentiment has been affected by the “headline new factor,” the Emerging Trends report also included rankings based on local perceptions of real estate investment and development prospects, which he said may be a more accurate indicator of current conditions.

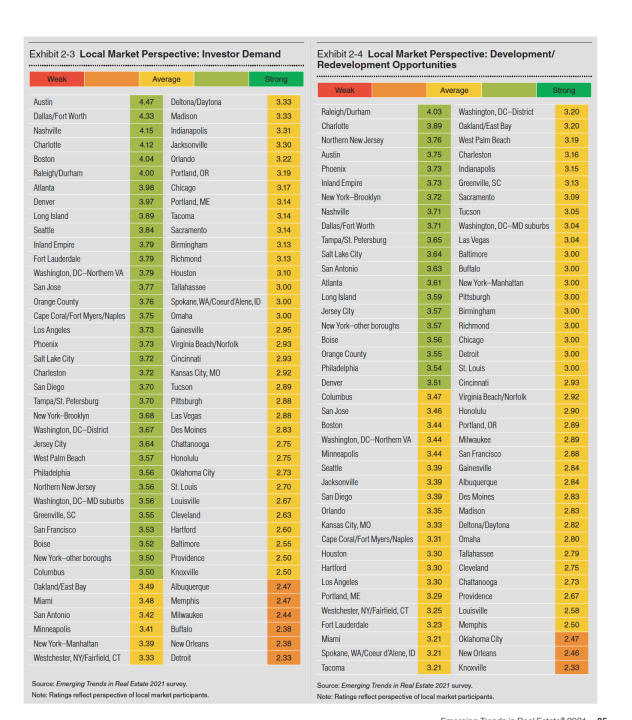

For example Portland’s Investor Demand rating by local market participants is about average, garnering a 3.19 rating out of 5. The city’s Development/Redevelopment Opportunities, as rated by local market participants, was a low-average score of 2.89. Though both of those lists included the 80 cities of the national ranking, Portland was not as low on the local lists as it was on the national one.

When asked whether the headline grabbing news that Portland briefly had the worst air quality in the world following the rash of 2020 Labor Day wildfires in adjacent areas possibly contributed to that negative perception, Wilkerson and Nelson said they thought it had (the report was released in October 2020). But Wilkerson said he doubts the wildfires will have a long term impact on investors’ perceptions.

Pre-pandemic market conditions may have been a factor

Some of the more run-of-the-mill factors also contributed to Portland’s slide in the ranking, such as high construction and land costs, Nelson said.

“Before the pandemic, we had too many office buildings and too many apartments in the central city already,” he said. “It got too popular in some ways and I think got somewhat overbuilt before the pandemic hit. So now you have the confluence of a more challenging economic environment for real estate investment, and then boom, the pandemic hits, and it makes it even more difficult.”

The headline news factor was just one more thing piled on top of that, Nelson said.

“I think we got a pretty tough run there, of tough news.”

Wilkerson said Portland has built more housing from 2017-19 than ever before on record in terms of number of apartments, however the city is still in need of more housing by 10s of thousands of units.

“I wouldn’t characterize it as overbuilt in real estate, but certainly on the office and the hotel side of things,” he said. “It got pretty speculative in terms of building offices without any pre-leased tenants. And certainly on the hotel side of things, we’ve seen occupancy rates drop again prior to even COVID. And certainly those have been negatively impacted, massively, during the pandemic.”

Nelson said he also thinks social issues that Portland has struggled with since before the pandemic, such as racial inequity and homelessness, were made more visible due to the pandemic and racial justice protests, too.

“We can’t rest on our laurels of how popular we were in 2017. We were #3, great, well we got a lot of work to do to make our community more attractive to live and to work.”

Chris nelson, principal of capstone partners llc and district council chair for urban land institute in portland

He added that he thinks the Black Lives Matter and racial equity movement in general, which at its peak saw many thousands marching in the early summer of 2020 in Portland, may have been a positive for the city. He said that excludes some who were not part of those movements but who were “bad people that came along that had nothing to do with it.”

“A lot of young people and a lot of companies that are concerned about a more inclusive society and a more shared prosperity are going to look at the values of Portland as: Hey that’s the city that really wants to be at the forefront of a more inclusive economy, a more diverse economy, a more diverse and a more equitable society,” Nelson said. “And that ultimately I think will be a positive factor.”

Portland has seen more than 100 days of consecutive protest sparked by the Minneapolis in-custody death of George Floyd in late May 2020.

Ranking is warning, not ‘doom and gloom’

Nelson said ultimately he doesn’t think the #66 ranking means that Portland is going to be a horrible place to live and work going forward.

“I do think it’s a good warning, though,” he said. “We can’t rest on our laurels of how popular we were in 2017. We were #3, great, well we got a lot of work to do to make our community more attractive to live and to work.”

Wilkerson agrees: “I wouldn’t paint it as the report in and of itself is doom and gloom. But I think certainly we have a lot of uphill battles to address here and we’ve been a little bit slow, if anything, in responding to some of these things. And so I think if, if anything, if this report helps catalyze everyone’s focus on this is maybe worse than we thought, nationally, what can we do to kind of remedying some of the circumstances that got us here.”