PORTLAND, Ore.- As the Federal Reserve implements its highest interest rate increase in over 40 years, Portland’s hot market could cool down.

Three interest rate increases in 2022 have driven an average 30-year mortgage rate from 3.11% on December 30, 2021 to 5.78% on June 16, 2022, according to reports from Freddie Mac.

Gerald Mildner, professor emeritus at Portland State University who used to direct the school’s Center for Housing, expects home values to increase, but not nearly to the tune of 12% annual increase seen in recent years.

That should relieve the “pressure cooker” of a housing market as Mildner describes.

“It will be a slower number. The challenge will be for buyers and sellers to get a more realistic number of what their home is worth, either the home they’re selling or the home they’re buying,” he told KOIN 6 News.

The cooling will come from the buyer’s side of the equation as interest rates will severely limit buying power.

Mildner crunched the numbers, comparing those average rates for the payment on a $500,000 home.

Mildner found payments will cost nearly $900 per month.

“When rates and prices change that much, often that leaves people like deer in the headlights.” Mildner said, “They don’t know how to react to that information.”

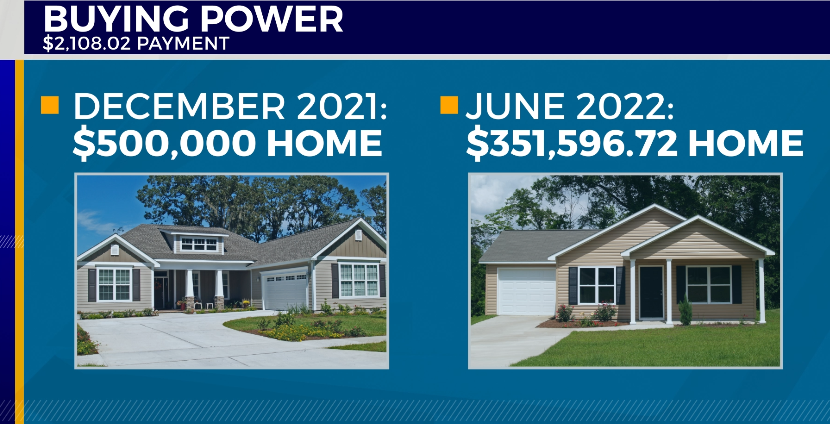

He also flipped the equation, looking at how much a person who can only pay $2,108.02 a month can afford now:

Mildner’s calculation found those buyers would lose more than $150,000 in buying home. He believes that will turn prospective buyers into prolonged renters.

“I would anticipate that getting tighter and more expensive particularly as you see people who would otherwise buy homes saying, ‘I’m going to wait 3 months, I’m going to wait 6 months, to see if conditions for buying get any better. So, I think it’s a tough time to be a consumer, regardless of if you’re trying to buy a house or regardless of if you’re trying to rent an apartment.”

Mildner takes issue with the City of Portland’s permitting process for slowing building, though acknowledges some elected leaders are trying to change the process to make it easier.

Ron Garcia, the executive director of public policy for Oregon’s Rental Housing Alliance says Oregon’s Rent Control bill will put upward pressure on prices.

One reason is the rent control formula limits annual increases at no more than 7% plus the rate of inflation when the tenant is the same.

“The challenge will be for buyers and sellers to get a more realistic number of what their home is worth, either the home they’re selling or the home they’re buying.”

— PSU Professor Emeritus Gerald Mildner

The formula sets no control for new tenants, and Garcia said that incentivizes landlords to take advantage.

“When they get a vacancy, it’s like a ‘Get Out of Jail free’ card,” Garcia describes, “They all of the sudden can redo the property, push those rents much higher. And who does that benefit? It’s not going to benefit the people that are most at risk of the housing need.”

RHA represents “mom and pop” landlords as Garcia describes it. Garcia is a property manager himself, and of his more than 500-units, reports two vacancies.

June is typically the time of year where around 20% of the market is turned over.

He said in the Great Recession prospective sellers who could not sell homes become ‘unintentional landlords” and expects them to try and make the most out of the situation as well.

“If they decide to put their properties in the rental market, it will be for a shorter period of time, one year or less, and they will be at the highest possible rent rates that they can get because there’s so little inventory.”