PORTLAND, Ore. (KOIN) — The pandemic was very good for the pot business.

Cannabis sales in Oregon skyrocketed in 2020. They increased nearly 40% year-over-year and total sales broke the $1 billion mark for the first time, according to the Oregon Liquor Control Commission’s 2021 Recreational Marijuana Supply and Demand Report, which was released Feb. 1.

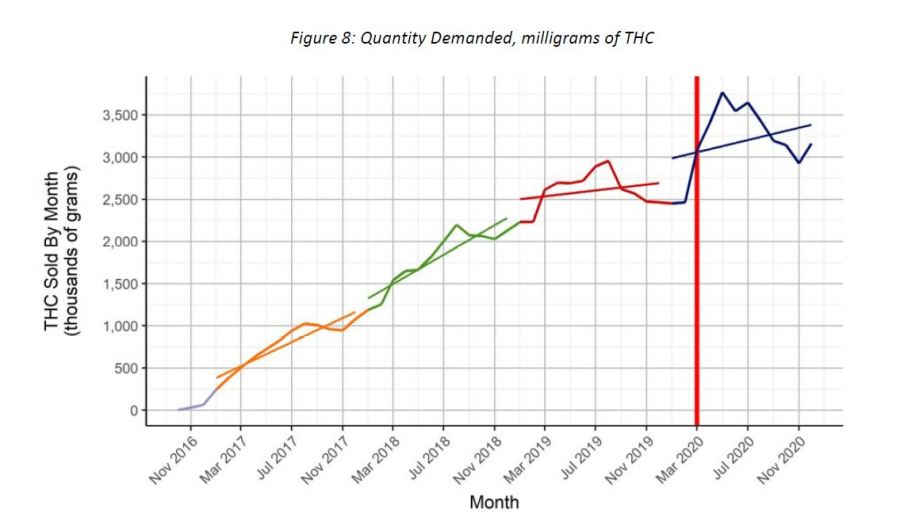

The biennial report, which covers supply and demand trends in both 2019 and 2020, says the long-term demand trend since mid-2018 has shown strong growth, but it began to flatten in 2019 and the beginning of 2020. That plateauing line took a sharp leap when the pandemic hit and sales started to boom.

“It really started happening in March and then when there was a fear that dispensaries might be forced to closed, there was basically a run on the store,” said Rick Vranish, marketing director at Tetra Cannabis, a dispensary with locations in Troutdale and Portland.

Vranish said at first, the surge was a bit scary for his employees. He said about 250 people were coming into their stores each day, at a time when not much was known about the spread of the virus.

He estimates their sales were up about 100% in March.

The OLCC says the months of March through July 2020 were unprecedented for consumers.

While there’s no way to determine what specifically was driving more people to shop at dispensaries, Mark Pettinger, spokesperson for OLCC’s recreational marijuana program, says there’s plenty of speculation. He said the stimulus check money given to everyone this year could be one factor influencing people’s purchases.

Vranish has other ideas of what he thinks is contributing to ongoing the trend.

“I’m sure to an extent it’s the lack of other things to do. So, without movies, theaters, without restaurants, sitting at home with some weed suddenly becomes more appealing to more people,” he said.

In its report, OLCC said the increased unemployment benefits during the early months of the pandemic raised household incomes for some people, which might have allowed them to spend more on cannabis.

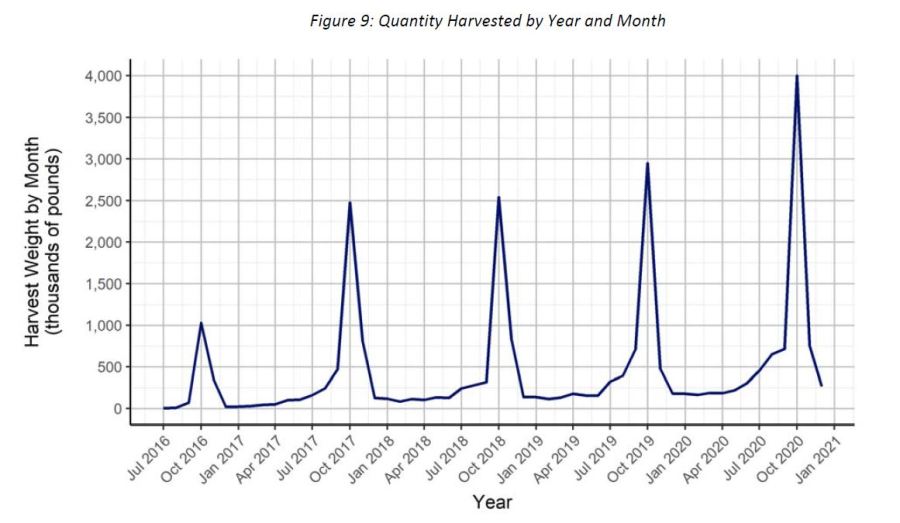

The recreational marijuana report, which includes data from both 2019 and 2020, says that in those two years, production has increased by 78% while the amount of cannabis sold increased by 150%. This larger increase in consumption has boosted demand to now use 65% of the total supply. When the previous report was released in 2019, the demand was only 50% of the supply.

OLCC sees these numbers as promising. The state has dealt with a supply of recreational marijuana that far outweighs the demand since legal sales began in 2016.

However, for dispensaries, the spike in demand has made it more difficult for them to get their hands on the products they want to sell.

Vranish, from Tetra Cannabis, goes so far as to say he feels the state is approaching a shortage. He said suppliers have increased their prices significantly as they’ve seen demand increase. Vranish said when wholesale prices dropped in 2018, his company was typically paying between $300 and $500 per pound for flower products. Now, those prices don’t exist anymore. Vranish said $800 per pound is considered cheap and $3,000 isn’t unheard of.

“The producers are back in control and I don’t know if maybe they will start issuing grower licenses again, but they haven’t shown any sign of doing that,” Vranish said.

The licenses he’s talking about are producer licenses.

In the 2019 Legislative Session, Oregon lawmakers passed Senate Bill 218, which placed a moratorium on producer licenses, meaning the OLCC could refuse to issue any more licenses for applications received after June 15, 2018. The moratorium remains in effect until January 2022. This was meant to limit the amount of oversupply Oregon had in its recreation marijuana market and prevent excess from seeping into the black market.

However, now, after such a wild year of sales, Vranish thinks OLCC should start accepting more applications again.

Since the bill went into effect, OLCC has still been processing its backlog of applicants. The commission only approved 30 applications between December 2019 and December 2020. There are still between 100 and 150 applications remaining in the backlog, according to Pettinger, from the OLCC.

He said they’ve made some changes recently that he hopes will speed up the approval process.

“We ask licensees that are ready to go, who’ve got all their stuff done and are eager to get open for business that they contact us and let us know and then we move them a little further ahead in line, in front of those who may not have all their stuff together,” he said.

He said they’ve also found ways to do remote inspections.

The wildfires were also a factor impacting the 2020 recreational marijuana supply. OLCC says the 2020 wildfires didn’t affect the market as significantly as they have in years past, but Hunter Neubauer, co-founder of Oregrown, says smoke was definitely an issue for their yield.

“During the prime flower cycle, we lost a good 30 to 40 days of sunshine and so that really affected our yields,” he said. “Just like a human, when you’re outside and you shouldn’t be breathing that type of air, it’s the same thing for a plant, right? Photosynthesis isn’t happening as fast as it could.”

Now, as the pandemic stretches into 2021, the OLCC, growers, and retailers are all wondering how the recreational marijuana business will continue to be affected and if this “COVID bump” will sustain?

Although it’s unlikely Oregon will see the unprecedented growth it experienced in 2020 again, OLCC says it feels relatively certain that both demand and production will increase in 2021.

Neubauer hopes this is the case for his company. He said Oregrown is already making changes in anticipation of strong sales in 2021. He said the company isn’t expanding its infrastructure, but it is investing in its employees and cultivation practices with the goal of producing a larger, better quality harvest with more sustainable agricultural practices.

Even if the sales trends flatten in 2021, Neubauer said he feels the investments the company makes now will pay off in the long run. He strongly believes that in the next five years, interstate commerce for marijuana will open up and Oregon will blazing the trail for selling products to other states.

Vranish, from Tetra Cannabis, also has his eye on federal changes in marijuana policy that could come about in the next few years. He believes once the doors open to other states, Oregon’s pot won’t just be a popular item on its own turn, but across the country.

“I think Oregon cannabis will always have a certain cachet. I think we have good product compared to most if not every other state… I just think it will always be in demand,” he said.